Study: My Understanding of

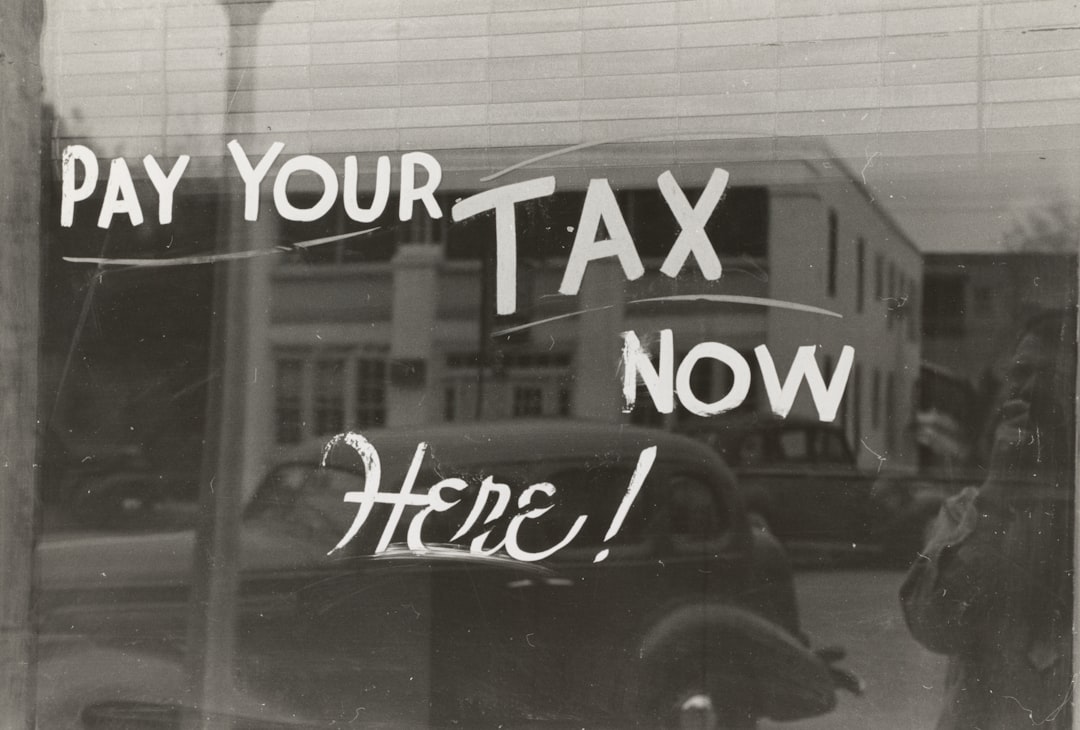

All the states require that each resident should pay tax to enhance the development of the country as well as the many projects that country engages in. A lot of people prefer to hire the services of an individual to file their taxes as they fear that they might end up messing in the process if they do it themselves. There are serious consequences that follow in you file your tax wrongly and this is the main reason here are a lot of people who choose to hire the services of a professional. The following are the major tax prep tips that you will have to make sure that you know which will be able to help you out.

One of the major tax prep tips that you will need to make sure that you know about filing taxes is trying bunching deductions. You will need to make sure that you plan your expenses by putting all the deductions in a single year and not spread them out to many years and this process is what we call bunching. There are a lot of merits that you will be able to get by using the bunching method which will be able to give you an easy time when you are filing your taxes in the next period, learn more about this company in this page.

You will need to make sure that you maximize on your retirement contributions and this is one of the many key tax prep tips that you need to learn that will be able to help you out. It will be a wise idea to make sure that you maximize on the amount of money that you save as retirement contributions and by doing this will end up paying less tax, here in this website you will read more about this product in this page. When you choose to save more as retirement contributions you will be sure that the funds are tax-free, view here for more.

It will be a good idea to make sure that you take out required minimum distributions and this is among the major tax prep tips that you need to learn. There is a heavy fine that you will be forced to pay when you fail to take out your minimum distributions and it will be a good idea to make sure that you hire the services of a pro who will be able to help you out with the issue, click here for more.

To conclude he points that are discussed in the context above shows the key tips that will need to make sure that you learn concerning tax prep.

A Guide on Account Receivables Financing

A Guide on Account Receivables Financing Different Tax Tips Vital for Newly Married Couple

Different Tax Tips Vital for Newly Married Couple Various Ways Of Making Quick Money

Various Ways Of Making Quick Money Different Kinds of Business Loans

Different Kinds of Business Loans Tips That You Can Use To Save Money While Still In College

Tips That You Can Use To Save Money While Still In College Read More Now on How You Can Outsourcing Cheaper For Your Company

Read More Now on How You Can Outsourcing Cheaper For Your Company Info That is Worthy Knowing About Debt Consolidation

Info That is Worthy Knowing About Debt Consolidation

Some of the Things That You Must Do If Your Relative Won’t Pay

Some of the Things That You Must Do If Your Relative Won’t Pay